Planning retirement is one of the most important financial steps for government employees in Pakistan. This Pakistan Pension & Commutation Calculator 2025 is designed specifically for federal and provincial government servants to estimate their monthly pension, commutation amount, and medical allowance, in accordance with the latest applicable pension rules.

This tool provides a clear and practical estimate to help you understand your post-retirement benefits before submitting your official pension case.

For a complete view of your salary and tax, check out our Pakistan Salary Tax Calculator for 2025–26

How Pension Is Calculated in Pakistan (2025-26 Rules)

In Pakistan, government pension is calculated under the Defined Benefit Pension System. The calculation is primarily based on three key factors:

-

Average Pensionable Pay

- Pension is calculated using the average of the last 36 months’ pensionable emoluments, which generally include basic pay and approved pensionable allowances.

-

Qualifying Service

-

Total qualifying service is calculated from the date of joining to the date of retirement, with a maximum limit of 30 years.

-

- Months 1–6 are counted as the current year.

- Months 7–12 add one additional year.

-

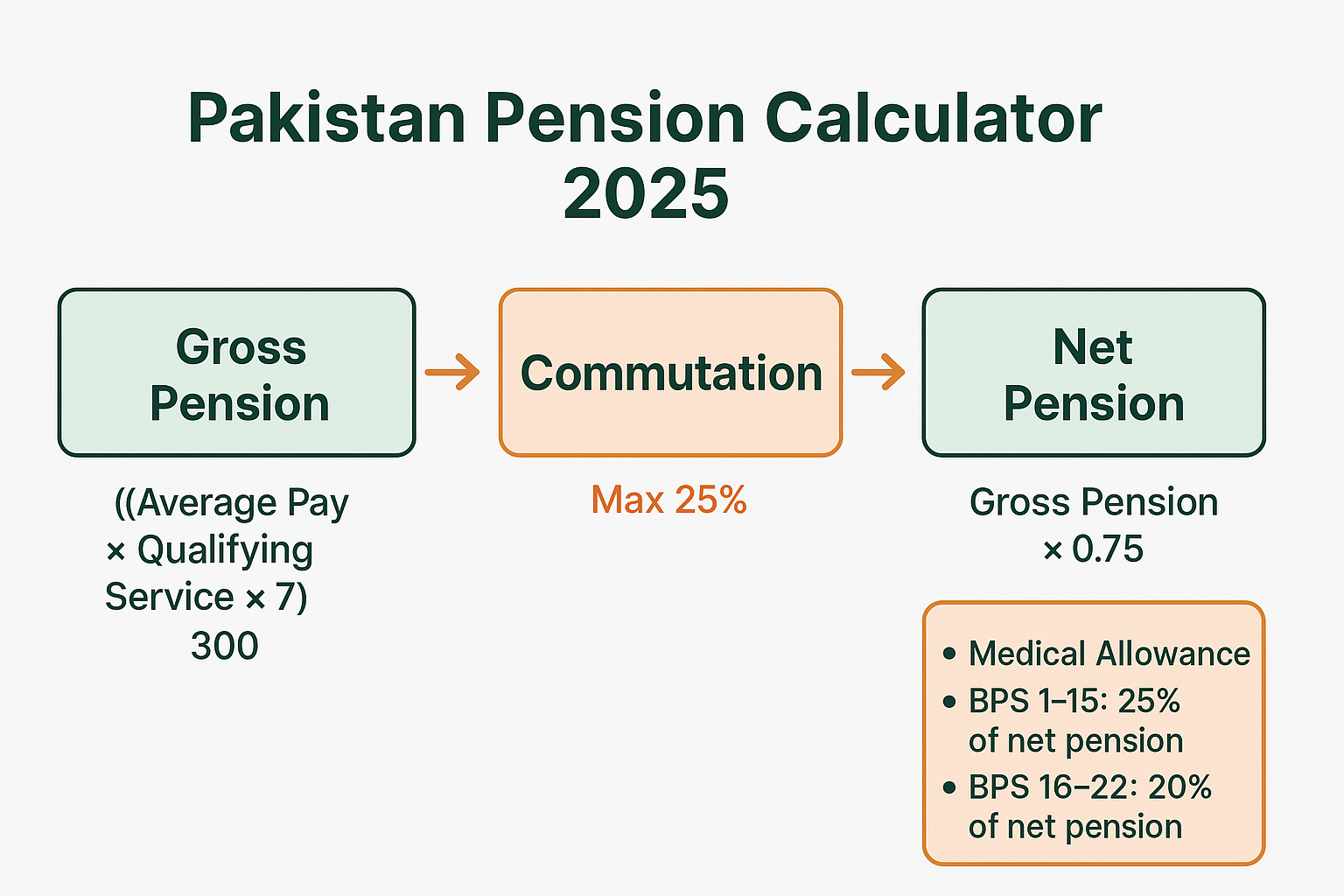

Gross Pension Formula

Gross Pension = (Average Pay × Qualifying Service × 7) ÷ 300

This calculator automatically applies these rules to provide accurate estimates.

Government Pension & Commutation Rules

Government employees in Pakistan are allowed to commute up to 25% of their gross pension into a lump-sum payment at the time of retirement.

Key Commutation details:

- Maximum commutation: 25% of gross pension

- Commutation factor: 12.3719

- Remaining pension: 75% payable as monthly net pension

Choosing commutation provides immediate financial support while reducing the monthly pension amount accordingly.

Medical Allowance for Pensioners

Medical benefits after retirement are calculated from the pension figure and are applied differently for each government pay scale:

- BPS 1–15: 25% of net pension

- BPS 16–22: 20% of net pension

- Additional medical allowance: 25% of the basic medical allowance (where applicable)

These allowances help retired employees manage healthcare expenses after retirement.

Minimum Pension in Pakistan

The Government of Pakistan has set a minimum pension threshold of Rs. 10,000 per month for eligible pensioners.

If the calculated pension amount falls below this limit, the minimum pension rule is applied to ensure basic financial security.

Retirement Age in Pakistan (Government Employees)

Retirement age in Pakistan for government employees is generally 60 years for both federal and provincial civil servants. Retirement occurs on the last working day of the month in which the employee attains the age of superannuation.

The applicable retirement age directly affects pension eligibility, the calculation of qualifying service, and commutation benefits. Employees who retire earlier due to voluntary retirement or departmental reasons may have reduced qualifying service, which can impact their final pension amount.

It is important to note that certain categories of employees, such as judges, armed forces personnel, or contractual employees, may have different retirement age rules under their respective service regulations.

Who Can Use This Pension Calculator?

This Pakistan Pension Calculator is suitable for:

- Federal government employees

- Provincial government employees (Punjab, Sindh, KPK, Balochistan)

- Retired civil servants

- Employees approaching superannuation

This tool is not applicable to employees covered under the Contributory Pension or Defined Contribution Schemes introduced in some provinces.

Important Notes & Disclaimer

- Federal pension rules generally apply across Pakistan, but provincial variations may exist.

- This calculator provides an estimate only.

- The final pension amount is approved by AGPR or the relevant Provincial Accounts Office.

- Always verify calculations with your department before submitting official documents.